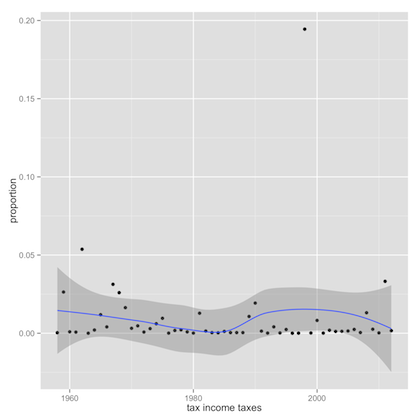

tax income taxes rate benefits taxation program households social rates transfer household payments transfers base consumption amount benefit programs

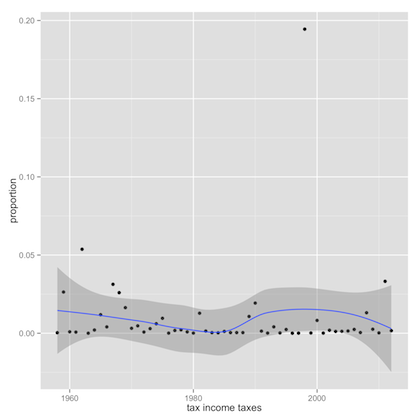

tax income taxes rate benefits taxation program households social rates transfer household payments transfers base consumption amount benefit programs