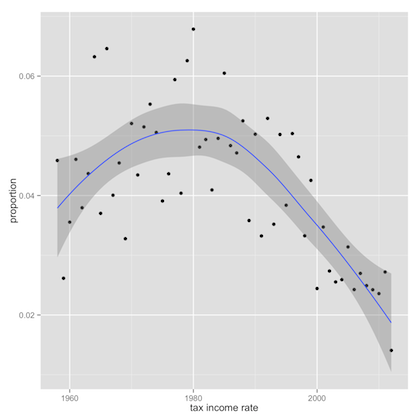

tax income rate divorce consumption program taxation benefit social effect transfer government expenditure individual taxpayer policy marriage revenue payment

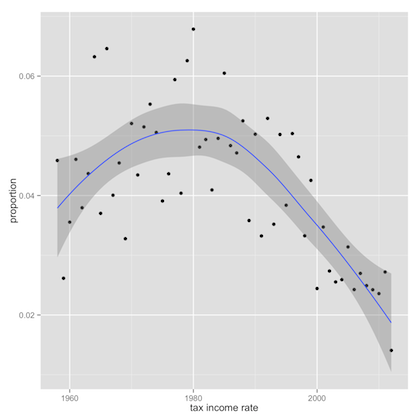

tax income rate divorce consumption program taxation benefit social effect transfer government expenditure individual taxpayer policy marriage revenue payment